Basically, the clause means that the insurance company can deduct premium payments from the accrued cash value if you should be late on your premium payments. Additional protections are available for whole life that aren’t available for term life.

2021 Ultimate Guide To Premium Financed Life Insurance - Banking Truths

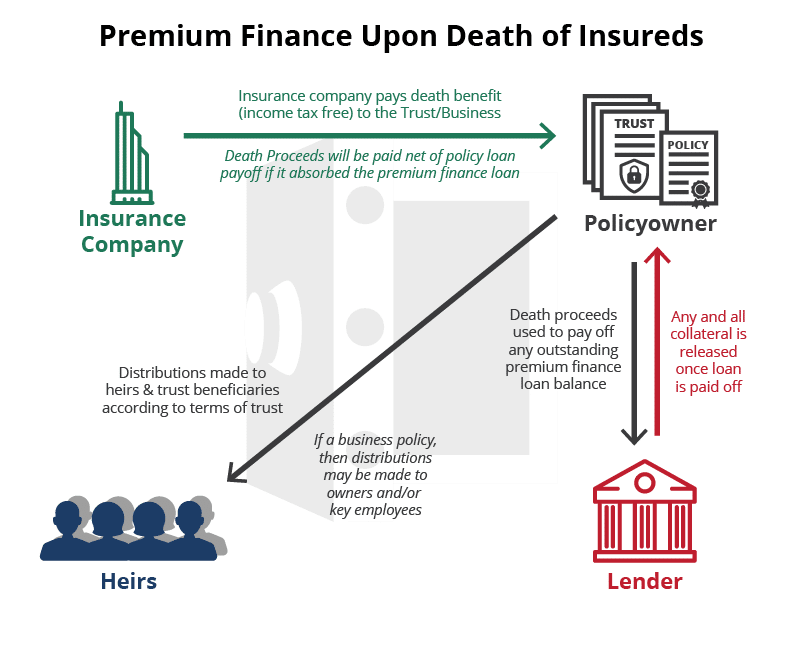

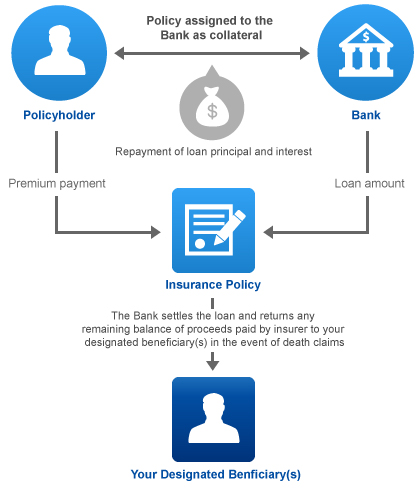

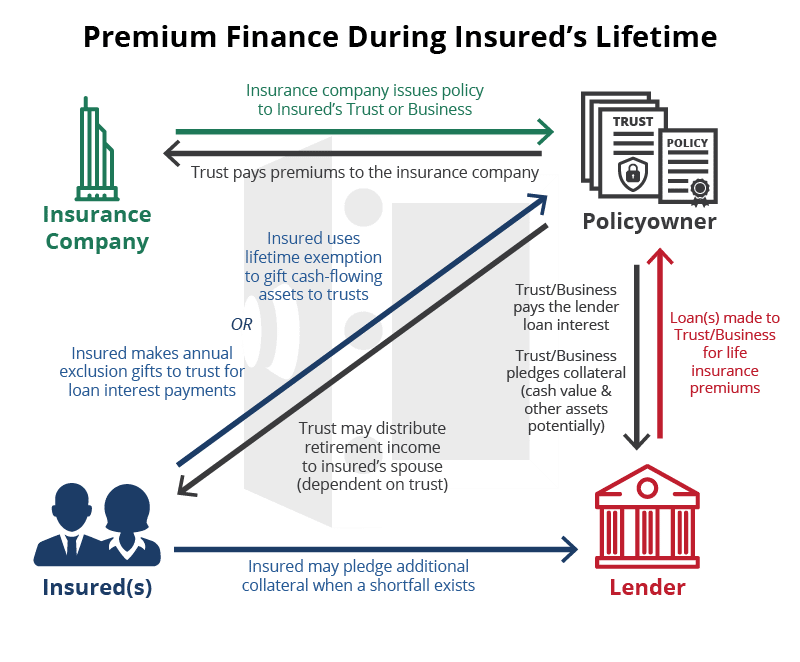

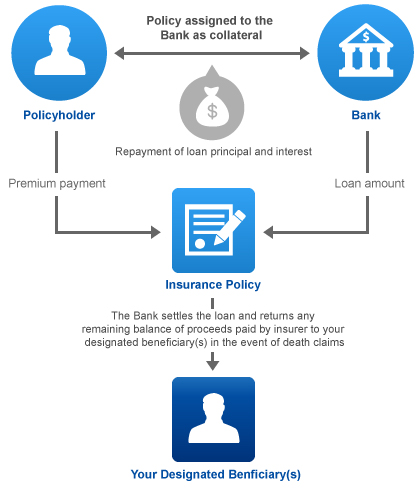

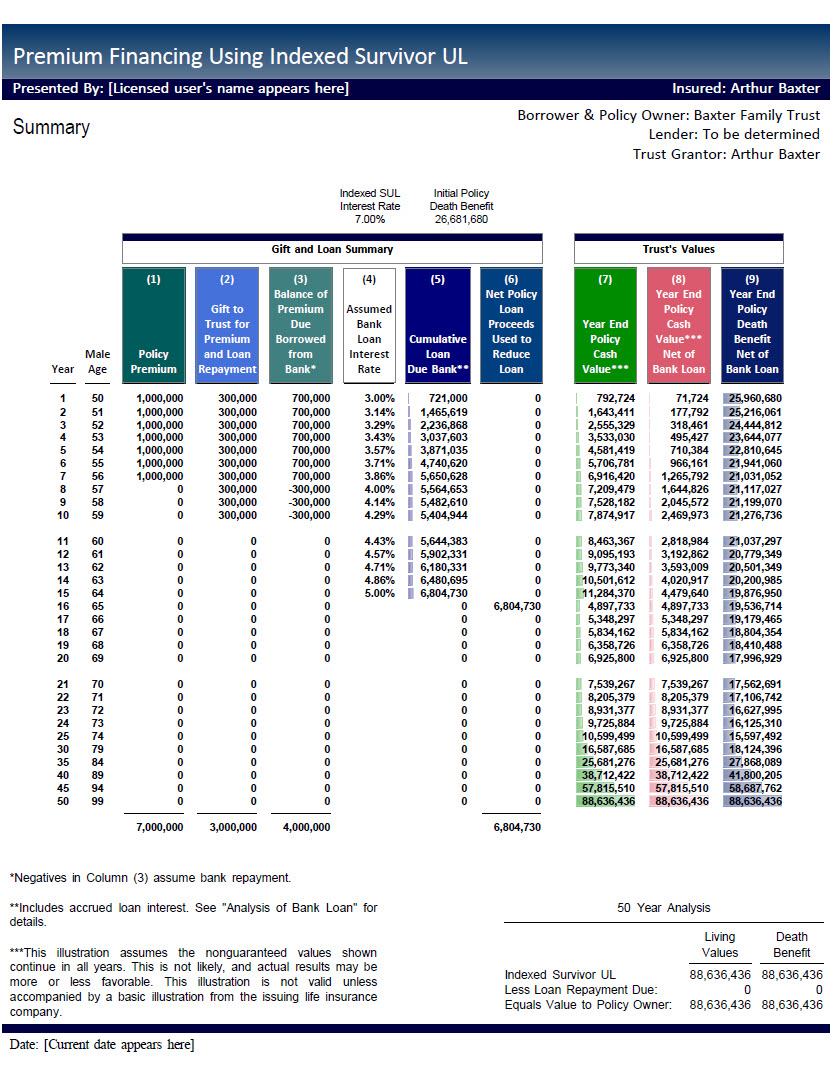

Premium insurance financing enables high net worth individuals (hnwi) to obtain life insurance at minimal cost by arranging financing from a lender to cover the policy premiums.

Premium loan life insurance. This amount is known as the cash surrender value. Ad term life insurance made easy. On a joint life cover, a discount of 10% is applicable on each joint life premium.

Term life insurance your way. What is premium financing for life insurance? Term life insurance your way.

An automatic premium loan is an insurance policy provision that allows the insurer to deduct the amount of an outstanding premium from the value of. Hnwis are unlikely to want to liquidate assets to pay for such premiums and therefore opt for premium financing. Once the loan is approved, the lender pays the annual premiums on the life insurance policy and the policyowner (or a trust) will only have to pay annual interest on the financed premium.

I will discuss nonforfeiture options in a later post. This plan covers your debt and pays off your financing institution in case any eventuality. Ad term life insurance made easy.

In the event of a missed payment, or delinquent payment, the company will make an. Reducing cover and level cover. It is important to remember that premium financed insurance is.

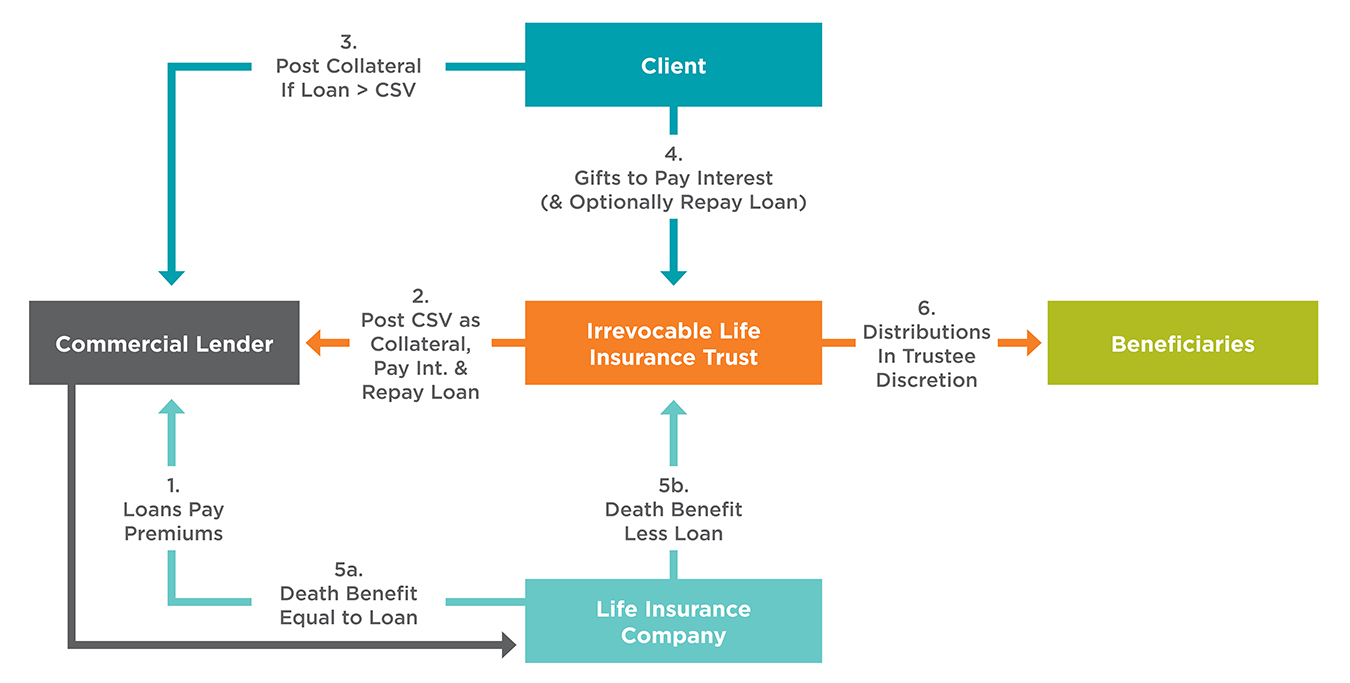

Although premium financing may seem like a simple concept, it actually involves complex transactions—and risk. With a premium financed program, the potential insured applies for premium financing after being underwritten for a life insurance policy. Steven goodman / life insurance.

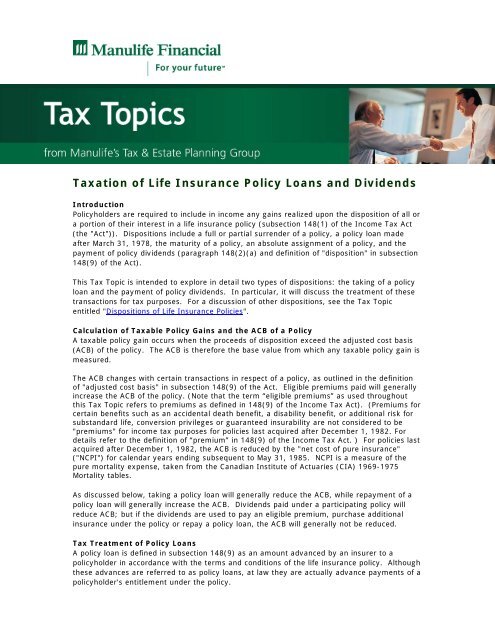

What is premium finance life insurance? This practice is acceptable within the insurance industry and would allow va to offer loans against the remaining available cash value of veterans' life insurance coverage, and reduce. • the lender may choose to not renew the loan.

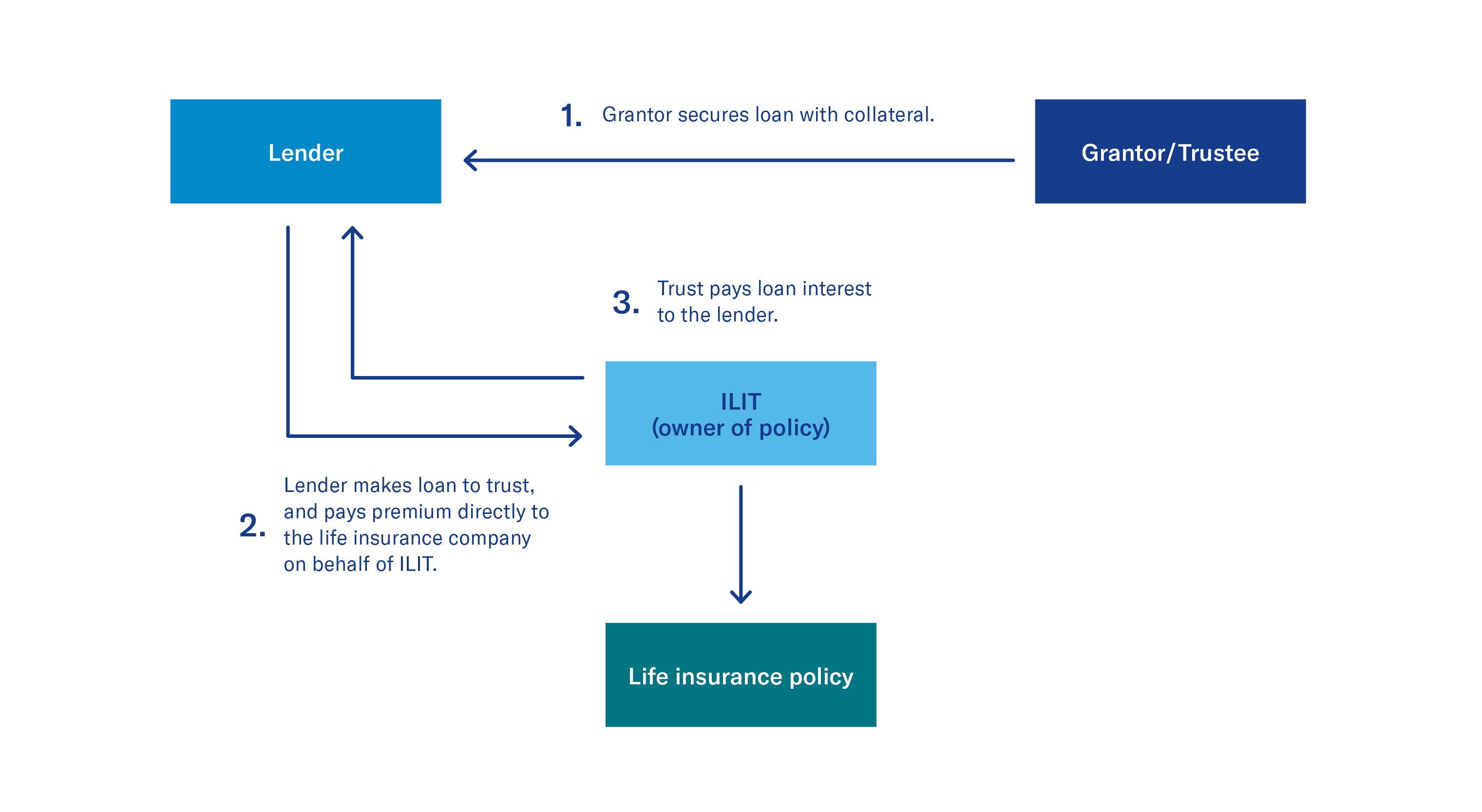

Premium financing is often used when a life insurance policy is owned by an entity—for example, an irrevocable life insurance trust (ilit)—which may not have enough cash or assets to make large premium payments. Using loans to pay life insurance premiums. Among the potential problem areas are the following:

Premium financing concerns borrowing money to pay life insurance premiums. A loan can be taken against the cash value in order to make premium payments, or a nonforfeiture option can be invoked. While there may be multiple reasons to employ this strategy, it is often used to avoid liquidating other investments to pay premiums.

Regardless, if we are talking about automatic premium loan, this term is frequently linked to a life insurance policy since it includes a cash value account. Whole life uses the plan’s cash value to extend coverage if premium payments stop. The loan he seeks will pay his life insurance premium, and bill will agree to pay the interest due on that loan.

If someone has a life insurance policy with cash value, the premium payments will accumulate over time. What is life insurance premium financing? The loan insurance plan will be covered under the following variants:

Premium financing is a strategy that involves taking a loan and using the proceeds to pay policy premiums (and, in some cases, the interest on the loan itself) during an. It is borrowing money from a third party to pay the policy premiums. Borrowing money to pay life insurance premiums is not a riskless strategy.

The automatic premium loan clause is a clause that is commonly found in cash value life insurance policies.

Premium Financing For Estate Planning Purposes Chamberlin Financial Inc

What Is Life Insurance Premium Financing Schechter Wealth

Premium Financing Recharge Wealth

Third Party Premium Financing - Nlec Nease Lagana Eden Culley

Taxation Of Life Insurance Policy Loans And Dividends - Repsource

The Best Premium Financing Life Insurance Top Benefits To Maximizing Your Cash Flow And Retained Capital

How To Get Loan Against Life Insurance Policy

Chapter 12 Life Insurance Contractual Provisions - Ppt Video Online Download

Chapter 12 Life Insurance Contractual Provisions Copyright 2017

Tier One Time To Consider Premium Financing

2021 Ultimate Guide To Premium Financed Life Insurance - Banking Truths

Insurance Financing Service Insurance Services - China Construction Bank Asia

How To Rescue A Life Insurance Policy With A Loan

Premium Financing For High-net Worth Clients

10

Automatic Premium Loan Provision The Insurance Pro Blog

Premium Financing Insmark

Premium Financing Decoded

Best Practices Financing Life Insurance Premiums

Comments

Post a Comment